PE ratio or PE multiple stands for Price to earnings ratio, which is computed by dividing the market price of a share by its earnings per share. It indicates how much an investor is ready to pay for each dollar of earnings of the company. For example, a PE multiple of 14 indicates that for each dollar of earnings, investor is ready to pay $14 for its share.

A low PE multiple of a share implies that share is undervalued while a high PE share is usually considered overvalued. The PE multiple of a company is usually compared with the industry’s PE or the PE of the peer companies.

The PE ratio is computed with the help of the following formula

![]()

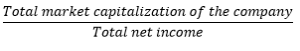

Alternatively, it can also be computed as follows:

Let us understand this with the help of an example. Suppose, the market price of company ABC is $150, the net income of the company is $200 million. The outstanding shares of the company are 20 million.

Now, we can compute the earnings per share by dividing the net income of the company by the outstanding shares i.e. $200 million / 20 million = $10 per share.

Therefore, the PE ratio of the company will be 15 i.e. 150/10.

If the industry PE multiple is less than 15, the share price of the company should be considered as overvalued, however, if the PE multiple of the industry is more than 15, the share value of the company ABC should be considered as undervalued.

Disclaimer: The above article is for educational purposes only. It should not be considered as an advice or recommendation for any type of investment or disinvestment. Please consult your financial advisor before making any purchase or sale of a share or any other financial security.